A while back I wrote about the ‘fast and frugal’ heuristics research of Gerd Gigerenzer and colleagues – in that case it was about research showing that a simple heuristic could provide decent predictions of election results. There’s lots more interesting research by these people – see the short bibliography below.

Another of the team’s proposals is the recognition heuristic: “If one of two objects is recognized and the other is not, then infer that the recognized object has the higher value with respect to the criterion.” They applied to this to numerous fields, eg getting people to guess the size of cities – but also to the stock markets.

Many thanks to the people who took my recent online survey, a small and slightly badly put-together attempt to explore this for myself. Gigerenzer and colleagues found that when they assembled stock portfolios on the basis of brands recognised most by the ordinary public (in the US and Germany), these significantly outperformed stock portfolios assembled by experts. Hey, nobody knows how to predict shares – least of all the experts.

So I took the names of the current constituents of the FTSE 100 Index and got 100 people to tell me which ones they recognised (so the various people who thought I made up some of the companies to test people… you were wrong), plus their country of residence and highest education level. I added the latter because the previous research showed that ‘recognition portfolios’ by college students did not do as well as those by the general population. In the end the research all seems to boil down to finding optimum levels of ignorance (for a pair of things, the recognition heuristic only works if you know precisely one of them).

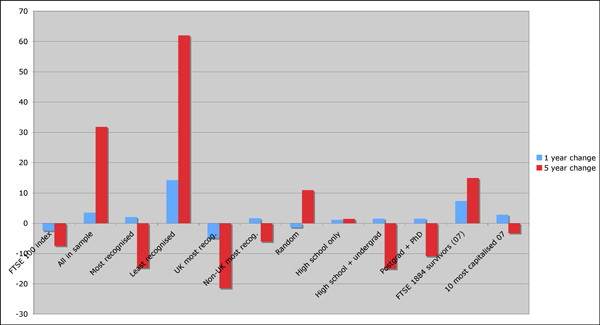

Aaanyway. My results do not really corroborate Gigerenzer et al’s research in any way, other than to show that reduced levels of prior knowledge (less education, or not living in the UK, so presumably knowing less about companies big in the UK) seem to offer some damage limitation at least. I’ll come back to this, but let’s have the results. Here’s the table and a graph:

| Constituents | Population sample | 1 year change (%) | 5 year change (%) | |

| FTSE 100 index | 100 | -2.5 | -7.5 | |

| All in sample | 92 | 3.5 | 31.8 | |

| Most recognised | 10 | 100 | 2 | -14.8 |

| Least recognised | 10 | 100 | 14.2 | 62 |

| UK most recog. | 10 | 87 | -5 | -21.5 |

| Non-UK most recog. | 10 | 13 | 1.6 | -6.1 |

| Random | 10 | -1.4 | 10.9 | |

| High school only | 10 | 8 | 1.1 | 1.4 |

| High school + undergrad | 10 | 50 | 1.5 | -15.1 |

| Postgrad + PhD | 10 | 50 | 1.5 | -10.9 |

| FTSE 1984 survivors (07) | 37 | 7.3 | 14.9 | |

| 10 most capitalised 07 | 10 | 2.8 |

-3.3 |

To explain further, ‘constituents’ means the number of companies in each ‘portfolio’. I’ve put the FTSE Index at the top, though this is a weighted index so doesn’t actually reflect aggregated share prices, which is what all the other figures are based on. The population column relates to the number of people (in my survey) relevant to each portfolio. Where possible I took the closing share prices on 13th February 2007, 14th February 2011 (13th not a trading day) and 13th February 2012. There are only 92 companies in my final sample because the other 8 didn’t exist back in 2007. If I’d done more prior research, rather than starting this on a whim, I’d have realised companies come and go from the FTSE 100 every quarter. The various portfolios are thus:

- all in sample: ie all 92 companies – clearly performed well, but it’s unlikely anyone would actually have assembled such a portfolio, so it’s really just to show what the subsets are working against

- most recognised = the 10 companies most recognised across my survey takers. Performed very badly over 5 years!

- least recognised = the bottom 10. Hugely successful, and rather undermining the recognition heuristic!

- the next few break down into UK-based and non-UK-based respondents, and levels of education; of course the non-UK and school-only groups have very sample populations, so the data is not perhaps that useful – but as I mentioned above, the groups with what might be expected to be the least knowledge of the UK markets… do a bit better

- out of curiosity I also tracked down a list of the original members of the FTSE 100 when it launched in 1984. In 2007, only 37 of these were still in the index, so I made a basket of those… and it did pretty well

- finally, a small portfolio based on the top 10 most capitalised members of the FTSE 100 in February 2007. As any motley fool knows, a lot has happened in the last five years (ie a recession).

So what’s behind the poor performance of the recognition heuristic in this study? Some possibilities:

- The recognition heuristic might be hornswaggle and Gigerenzer just got lucky

- Poor study design – obviously one would choose to track portfolios forward from now rather than using companies currently successful

- Poor sample selection: ie too many smart-arses read Twitter

- The recession has particularly hit banking and retail firms, which generally seem to dominate those people recognise most.

But I do find an interesting by-product of all this: the companies which have survived in the FTSE 100 longest (not worrying about cases where they may have fallen out and come back in again) do provide a respectable portfolio. So there’s something just in longevity – unless you’re Woolworth, Cadbury, HBOS, etc etc etc. Today there are 33 companies left from the original line-up (a few under different names). Send me a fiver and I’ll tell you who they are 🙂

Bibliography

Borges, B., Goldstein, D. G., Ortmann, A. & Gigerenzer, G. (1999). Can ignorance beat the stockmarket? Name recognition as a heuristic for investing. In G. Gigerenzer, P. M. Todd & the ABC Research Group, Simple heuristics that make us smart (S. 59–72). New York: Oxford University Press.

Ortmann, A., Gigerenzer, G., Borges, B. & Goldstein, D. G. (2002). The Recognition Heuristic: A Fast and Frugal Way to Investment Choice? in Handbook of Experimental Economics Results, 2008, vol. 1, Part 7, pp 993-1003, Elsevier.

Gigerenzer, G. (2007) Gut Feelings: The Intelligence of the Unconscious. Viking.

Disclaimer: I know nothing of the stock markets and am a dilettante statistician.